Life insurance marketing is often the trickiest type of marketing for many agents. Insurance itself is difficult enough to quantify, since it’s not an actual, physical product. However, at least with car, house, and even motorcycle insurance, it’s easy to sell your products because everyone knows what it’s like to need it if they were to get into an accident or experience some sort of disaster. But, life insurance is different and finding leads for life insurance is not just difficult but the subject itself is sensitive.

After all, no one wants to talk about death or the possibility of death (and that’s why we don’t call it death insurance.) However, that doesn’t mean insurance agents should just leave finding leads for life insurance to chance. There are ways you can acitively seek out leads, without having to resort to more desperate measures. So, here are 4 ways to get more life insurance leads and clients.

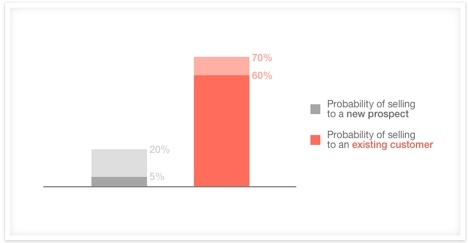

1. Go back to old leads

This may seem like a no-brainer, but your old contacts list may be a goldmine of leads! Sometimes, when you get in touch with a contact, they’re not quite ready to buy yet. There are many reasons why they might not need life insurance at that time. Perhaps they’ve just started a new job and don’t have a lot of money. Or maybe they don’t have a family or a partner yet. But, circumstances always change. That wide-eyed college graduate you spoke with six years ago may have gotten engaged or maybe he or she has been promoted to manager at their new job. That young couple you talked to six months ago might have a baby on the way. Or that entrepreneur you met at that conference two years ago is now the CEO of a growing company with multiple employees. While back when you first met them, they simply weren’t ready to listen to what you had to say, they may now be in a position to buy life insurance.

And, even if they’re not there yet, it’s always good to keep in touch with old contacts and refresh their memory (and yours). Then at a later date, once they are ready, they might even be the ones to contact you once they realize they need life insurance.

{{cta(‘d91cb109-8fd6-46c7-86b5-2b27ffb71f3d’,’justifycenter’)}}

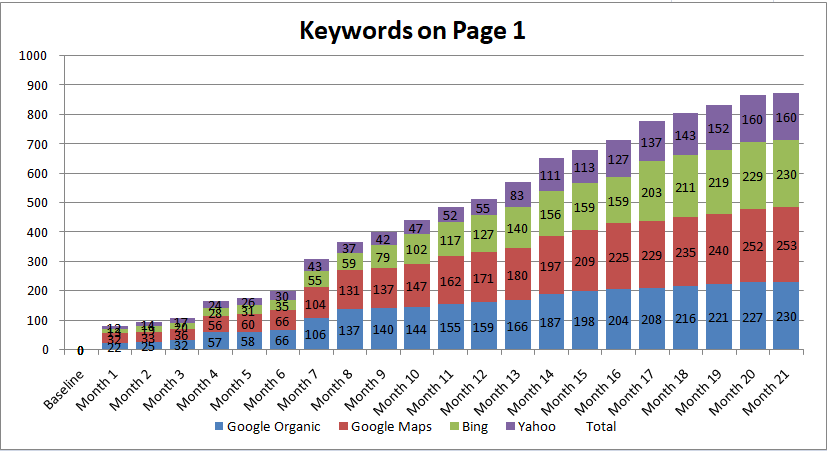

2. Invest in traffic instead of leads

Buying leads and lead lists are old-school methods of writing more life policies. However, today, purchasing lists of people’s contacts (especially email) straddles a thin, ethical line for some. Plus, these days, with Do-Not-Call lists and Anti-SPAM laws, it’s really difficult to get a good quality lists that will get you results. Not to mention, not a lot of people answer calls anymore, especially with the prevalence of text messaging, instant messaging and e-mail.

So, what can you do? Well, you can still invest some of your marketing budget, but not in leads, but Internet traffic. These days, driving traffic to your website or social media accounts. can be free or very inexpensive! By using the right keywords or investing in inexpensive Facebook or even Twitter advertising, you can drive traffic to your site and your social media accounts. Investing in traffic isn’t as laborious or expensive as calling everyone on a leads list. See, with traffic, you’re actually having people come to you, instead of you seeking them out. These people are alrready searching for life insurance and if your website is at the top of the search results page, then you’re in an excellent position to receive legitimate, life insurance leads that have the highest propensity to buy; they were already looking, so they’re probably much further along the buyer’s journey.

3. Use visuals in your social media accounts

We’ve talked extensively about social media, Facebook, Twitter, Linkedin , G+ and how to use them in your insurance agency marketing efforts, and you’ve probably already started using these sites. But, insurance agency social media marketing isn’t just about blasting your message on your timeline or chasing after leads. Social media is the best way you can show people who you are and what your agency stands for. Because insurance is not a physical product, most people decide who to buy from based on their relationship with the agent or agency. You can use relationship building, on social media, so that once these friends and family have a need for life insurance, they’ll be certain to reach out to you.

When you do share things on social media, try to use visuals. People’s brains love visual content – that’s a fact. Visuals are faster to process, more attractive, plus people remember them longer than just text. So, instead of just sending out messages, use pictures! You can use pictures of your office, your team members and even visual infographics to help get LK your message across.

4. Give people what they want

Finally, the last thing you can do to get more leads for life insurance would be to give people what they want. And what does that mean exactly? Well, in this day and age, it simply means you’re going to have to give people information. Information is the currency you can use to draw people in. Whether it’s giving them information about “fast facts” on their city, free advice or product information, you should be ready to share what you have.

Gone are the days when sales people have all the power and information. According to recent studies, about 57% of a person’s buying decision is done before they even talk to a sales person these days. Of course, you will still get people who don’t know anything about life insurance. But, whichever type of person you do talk to, make sure you’re ready to share information with them, whether it’s about the basics of life insurance or getting their details so you can give them a more substantive quote.

Life insurance is not easy to sell. Having the, “You need life insurance” conversation is challenging,, which is why many agents shy away from promoting this type of insurance with family and friends. However, as an agent, you can’t avoid certain topics, because they are uncomfortable. In fact, it’s your duty to help people be prepared when the inevitable comes. Of course, finding leads for life insurance isn’t a walk in the park either, but with these tips, you can surely build your business and find more potential clients out there who actually want to purchase from you.

{{cta(‘d91cb109-8fd6-46c7-86b5-2b27ffb71f3d’,’justifycenter’)}}