It’s a familiar scenario in car rental transactions: a customer, having just endured a long flight, has to face the uncomfortable discussion about rental car insurance coverage. They’re standing in the rental office, bleary-eyed and bedraggled being asked a far from simple question; “Would you like to add insurance?”

Many politely decline at this stage for a myriad of reasons. Perhaps their auto insurance already covers rental cars, maybe they don’t trust the car rental agent who seems to want to fleece them for more money, or it could be that they simply misunderstand what is required.

As insurance agents, there are issues to be solved here. Your clients would no doubt benefit from some friendly auto insurance guidance before they set off on their vacation – before they face the rental car salesperson.

Current Car Rental Insurance Policy

Some people may already have insurance coverage for their rental car through the policy that keeps them legally on the road during their day-to-day life. Neil Abrams, a consultant with Abrams Consulting Group, says “for people who already have collision coverage on the rental car, getting the rental policy is a waste of money.”

People’s current car insurance policy can be both a money-saver and a source of confusion. If they have adequate coverage on their standard policy, great; they will not need to spend money on extra coverage. If they mistakenly think that their auto insurance covers them in a rental car, though, they could be in for a big surprise.

Individuals could find themselves having to pay thousands of dollars to the car rental company if the car is stolen or they get into an accident. If, like most people, the client only has liability coverage, they might want to take out added coverage. Liability coverage will help provide for medical costs and property damage when a person is at fault in a crash. But, it usually does not cover damage to the rental car.

That means even if an individual already has auto insurance, they may still require additional coverage. At this point, agents can point out why current insurance policies are not sufficient. The purchasing of extra coverage could save them a lot of money in the event of some misfortune in the rental car.

Will the Credit Card Cover Things?

Several major credit card providers, including Visa, offer rental car insurance to cardholders. Some providers give these benefits to all their customers while others reserve the offer for elite members only. The offer is only relevant, however, if the person pays for the rental car with their credit card.

In some instances, the credit card insurance package acts as a secondary insurer. That means it only kicks-in at the level where damage or theft expenses are not covered by the standard insurance policy. So even if the individual intends to pay with a credit card, they might still need to buy personal auto insurance.

The credit card companies generally throw in coverage for the costs associated with theft and towing, but most do not cover medical and personal property; some cover the loss of use, while others don’t. The point is that you will need to look at each person’s case individually.

It may be that you will have to piece together a personal car insurance policy for tailored specifically for them; one that provides adequate coverage for the rental car, but doesn’t charge them for the things already covered by their credit card.

{{cta(‘d5cfd355-e14a-4ec0-bb24-9685ce785785′,’justifycenter’)}}

Underinsured or Uninsured

Confusion with car insurance can lead to people driving rental cars while being underinsured or uninsured. Helping them understand their policies and the coverage they might get from things like credit card offers is one way to avoid the perils of not having adequate insurance.

But what about other drivers? What if your client gets into an accident with a person who is underinsured? Here is yet another way that rental car drivers could find themselves potentially out of pocket. But, fortunately, there are ways to negate the risks.

One way to protect against that type of risk is by purchasing uninsured motorist coverage or underinsured motorist coverage. Both can be added to a current insurance policy. The former helps secure against property damage expenses, medical bills, and lost income if involved in an accident with an uninsured driver; the latter will kick-in at the limit of the underinsured driver’s policy.

Most people do not think about the consequences of an accident with an underinsured or uninsured driver. No doubt they would be surprised to learn that 12.5 percent of accidents in the USA are caused by uninsured drivers*. It’s a harrowing statistic that should make most people seriously consider buying uninsured driver coverage.

Car Rental Insurance Options

Everyone can, of course, buy insurance at the car rental office counter. For many, though, this is a time of high stress and high pressure, so they seldom make the right decision about something as complex as insurance coverage. They either end up paying for extra insurance that they don’t need, or they decline the offer and end up driving without adequate coverage.

If you can persuade them to talk with you in advance about their car rental insurance options, it would probably be to their benefit. In many instances, buying a standalone policy will be better for them than taking the option offered by the car rental company.

Important pieces of insurance coverage needed:

Liability Coverage:

This is probably the most important piece of coverage a rental car driver needs: it is by far the biggest financial threat. Liability insurance should be at least sufficient to cover legal requirements for the state that the individual is driving in, but additional coverage should be recommended. How about adding on a P.L.U.P (Personal Liability Umbrella Policy) for just a few additional dollars per month?

Collision Coverage:

Without collision coverage, your client might be liable to pay for any scratches, scrapes or dings that occur during the rental period. Some car rental firms will charge additional fees for their vehicle being out of use during repair.

Personal losses:

Although not as crucial as the above two options, protecting against personal loss can provide much-needed peace of mind. Encourage your clients to consider buying extra insurance coverage to handle things like theft of personal belongings while inside the rented vehicle.

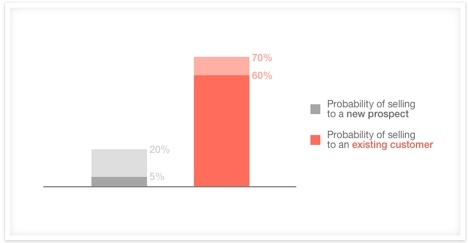

Helping clients navigate the confusing world of rental car insurance is one more way insurance agents can offer quality service to their clients. The more value you can provide to your customers, the greater your chances of beating the competition and establishing your brand as number one.

*Source – Statisticbrain.com – uninsured driver statistics