As an insurance agent, you’ve probably heard the same questions over and over again.

Based on my experience in the insurance business, there are common questions that I would get, especially from new customers. How I answer most prospects or customers depends on how much experience they have when it comes to doing research and buying insurance coverage.

Now, for most insurance agents, they can probably give the textbook, jargon-filled answer to many of these questions. But, remember, many of your customers may be first time insurance buyers and may not be familiar with many of our industry’s terms. . While these questions may be simple for you and I, it may be complex for them.

It’s important to break down the concepts into smaller, more understandable components. So, what I’ve done is collect the most common questions, and I answer them using the most basic terms.

By being prepared to answer these questions, you’ll be able to put your prospects and customers at ease, and help them make the right decisions. And ultimately, you can use these questions and answers to attract more insurance leads.

When we put people at ease and help them understand various concepts, they’ll want to do buy versus being sold. As I always like to say, “When you properly educate your prospect/customer, you allow them to buy; they don’t have to be sold.”

In this blog post, we will cover the following:

- Most frequently asked questions

- How best to answer those questions

{{cta(‘7267e964-fe68-49b5-b154-749a7cb89f30′,’justifycenter’)}}

Question #1

Should I Bundle My Policies With Home & Auto Insurance?

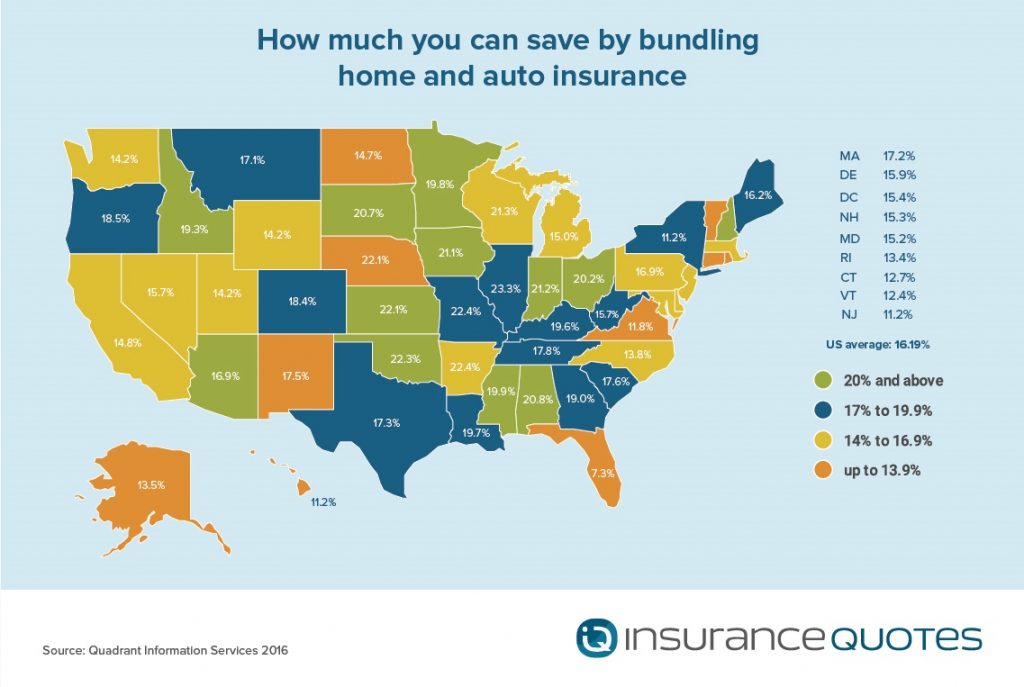

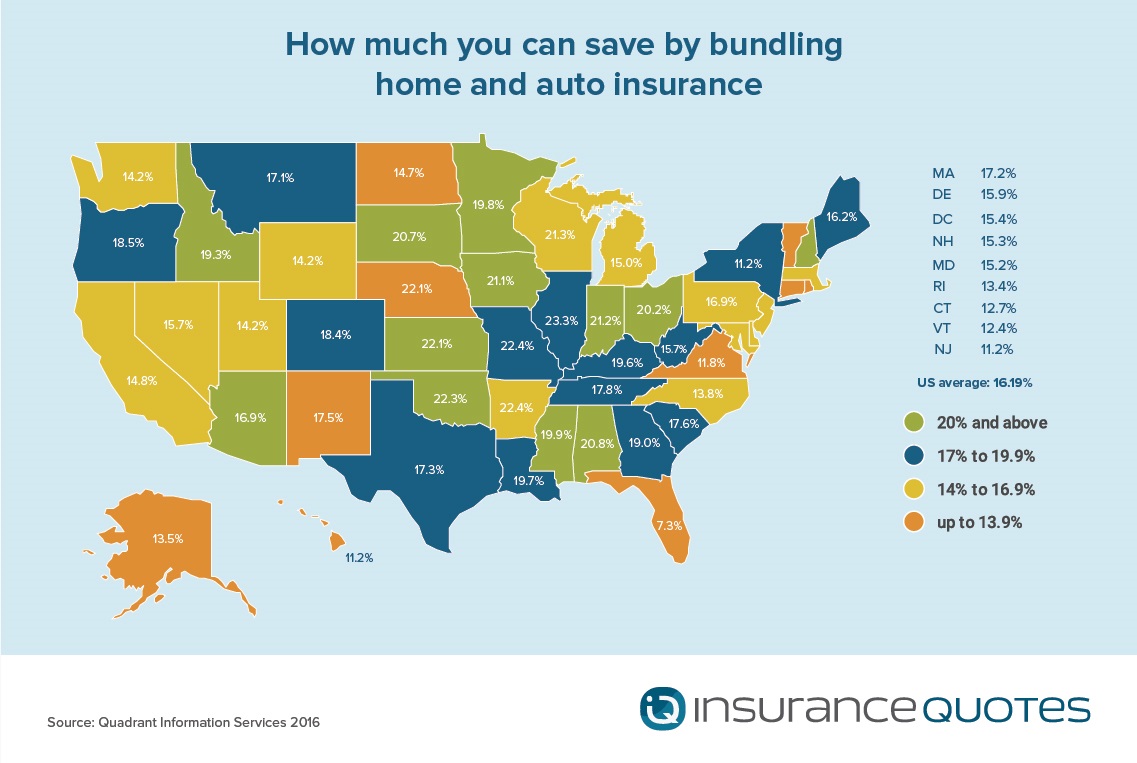

Almost always it is a good idea for customers to bundle their home and auto insurance policies. More often than not they get a substantial discount when they bundle, though the amount varies depending on a variety of factors, such as the type of policy, the provider, and the location.

SOURCE: https://www.insurancequotes.com/home/bundling-your-insurance-for-savings-092016

However, this is not exclusively for home and auto policy bundlers. Those who rent can also bundle renters and auto insurance. Same goes for people who own multiple cars who want to cover their vehicles under the same policy. It is important to remember that each customer has a unique situation, and it is important to explore the different types of policies they can bundle.

Customer satisfaction increases whenever they bundle policies according to J.D. Power and Associates. Customers feel “that insurers are doing a better job in offering the right coverage options at competitive prices when policies are bundled.”

Question # 2

What Is “Replacement Cost” vs What Is “Actual Cash Value”?

- Replacement cost is what the item would cost if you would buy it today

- Actual Cash Value is the cost of the product today minus depreciation

Let’s say your customer bought a TV for $2,000 dollars and it was damaged in a wild fire. Under Actual Cash Value the insurance company may only pay $1,500 dollars because that’s how much the TV would be worth now.

Replacement Cost – depreciation cost = Actual Cash Value

$2,000 – $500 $1,500

If they had chosen a policy with Replacement Cost, they would get a comparable TV–the insurer might have to pay more depending on how much it would cost to buy a TV today. If a similar product is worth $2,100 today, then that’s how much the insurer would have to pay. Along the same line, if a comparable TV is more affordable (e.g. $1,800), then that is what the insurer will pay and they will not refund the difference.

Question # 3

What is “Waiver Of Subrogation”?

This is a very important and somewhat complicated point that prospects and customers should understand. Subrogation is part of a car insurance policy and is often put into practice, by the insurer, in the event of an auto accident, where their customer wasn’t at fault.

This means that if a customer is in an accident and the other driver is at fault, the insurance company will pay to have the car fixed. It is the right of your customer to seek compensation and sue the at-fault driver. With a subrogation clause, the insurance company will be the one to sue the responsible party to recover the cost of repairs. Insurers will collect whatever the cost of the repairs are from the at-fault driver. This is used so that a car can get fix at the earliest possible time, to the benefit of the insured.

With a Waiver of Subrogation, the insurance company cannot recover the money that they paid on a claim from the negligent third party. Usually if a waiver of subrogation is included, then insurance companies may charge an extra premium.

Question # 4

Does Credit Rating Impact Insurance Costs?

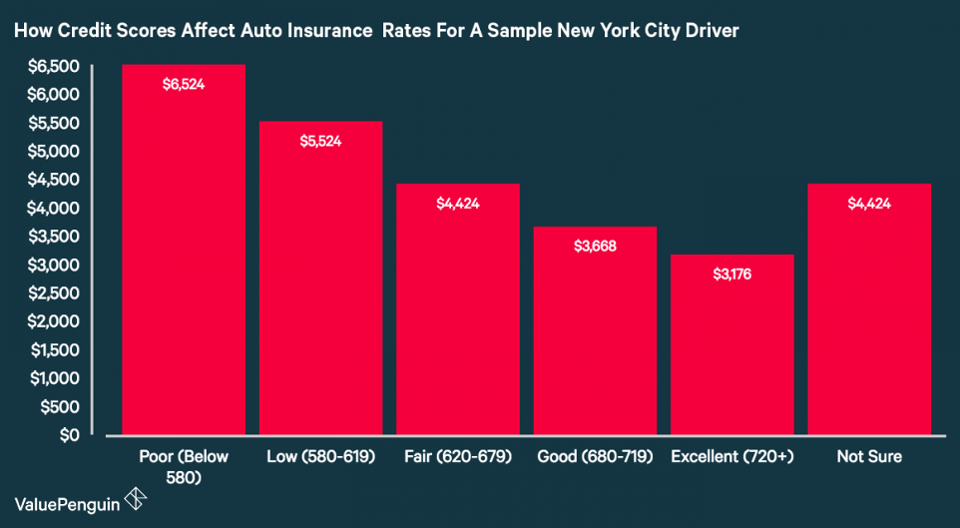

That’s an excellent question. The simple answer is yes, if they are in states where it’s legal for insurers to look at a person’s credit score to determine their insurance rates. Hawaii, California and Massachusetts are the three states where insurers are prohibited by law from using credit scores to determine premiums.

If you’re not living in those states, then yes, credit scores can impact premiums

Check out the graph above from a study by the FTC that shows, “credit scores were accurate in predicting the likelihood of an individual filing a claim.”

Now, if your customers are afraid of high insurance premiums, they can take these steps to improve their credit score:

- Track their credit score

- Checking any possible errors on their credit report

- Pay their credit card bills on time and in full every month (paying more than the minimum helps)

- Pay all debt in a timely manner

- Use 50% or less of credit balances

Question # 5

What Is An “Independent Insurance Agent”?

Independent insurance agents are able to sell insurance policies from numerous companies and are not representing one, specific insurance company, e.g., Captive Agent They have the ability to sell a variety of plans giving their customers a wide selection of coverage options.

If a customer is looking to get car insurance, an independent agent can come up with a list of different insurers so that their customer doesn’t have to shop around to multiple insurers.

Question # 6

Does My Age Impact My Premium Costs?

Age can definitely affect premium costs whether it be for health, auto or life insurance. Here are some ways how age can affect insurance rates:

- Health insurance – coverage for older people can cost up to three times higher, depending on a number of factors

- Auto insurance – statistics show that crash rates are higher for younger drivers, especially single males under twenty five, and rates reflect these differences

- Life insurance – the younger your customers are when they decide to buy a policy, the lower their rate. This is basically because they will be paying over a longer time period. Gerber has made a handsome living selling parents life policies for their new born.

Interestingly enough, for auto insurance, there is an age sweet spot – between 25-55 is the ideall age target. .These drivers are considered less risky than young adults (24 and younger) and older drivers (56 and above).

Students who achieve good grades may also be able to get a discount depending on their type of insurance coverage. Young drivers can also be bundled with their parents to lower their premiums, too.

It is good to note that New York and Vermont are the only states where age is not considered when calculating health insurance premiums.

Of course, age is not the only thing that is considered so there may be ways that customers can lower their rates.

Question # 7

Is It Important to Be The “First Named Insured” On My Policy?

This depends on how much responsibility the customer wants. In a nutshell :

- Typically he/she is the owner of the policy and pays the policy premiums

- They have certain rights and responsibilities – they are notified when the policy is cancelled, entitled to any refunded insurance premium dollars, they receive all communications regarding the policy, and they are responsible to pay for any amounts owed after a cancellation

- They can also cancel a policy or request for a modification of the policy

The first named insured cannot just be anyone, they have to be ready for the responsibility and the role they will play in maintaining the policy. Make sure to explain this clearly to your customer and discuss the different functions of this role.

Question # 8

What Makes Me “High Risk”?Again, another interesting question!

When a customer asks this question, your answer can fall into two different insurance categories – health or auto.

A high risk driver pays more for insurance coverage than the average driver. They have been determined to be “undesirable” because it may end up costing the insurance company more than they earn to insure that type of driver. Here are some common reasons how drivers are rated as high risk:

- DUI/DWI conviction – driving under the influence of drugs or alcohol can affect insurance rates for up to three years

- Serious violations and accidents – speeding, racing, driving without a license, accident that results in a fatality

- Driving record – drivers with a list of traffic violations and accidents within a five year period can be considered high risk

- New drivers – especially teenagers are more likely to be in an accident, their inexperience makes them high risk

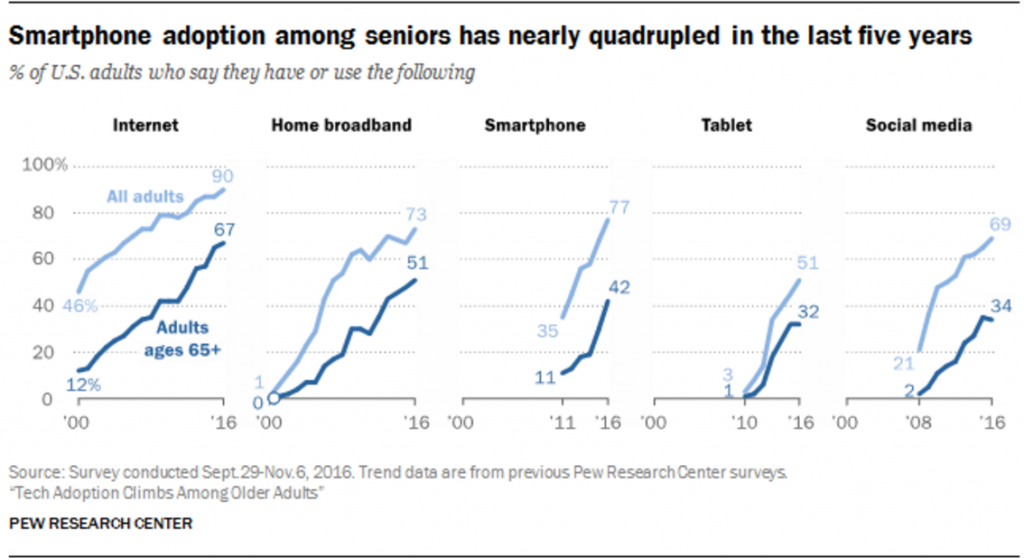

- Older drivers – those 80 or older may be affected by their vision and slower reflexes

- Exotic vehicles – sports cars, supercars and collectibles are expensive to insure

- Not having prior insurance – driving without insurance coverage is risky and will affect any coverage you get

Now, though it’s difficult to change some of these, it may not be too late to mitigate some of them. I advised my customers along the following lines, in case they want to reduce their chances of being rated as high risk:

- Take a defensive driving course

- Drive a car with a better safety record

- Go three years without a traffic ticket

- Avoid a car accident for three years

When it comes to health insurance, those deemed high risk are usually put in a pool together. These people are basically uninsurable and the very sick that cannot get insurance coverage.

This was a big issue before the Affordable Care Act, because it was the only way that people with pre-existing conditions could get health coverage. Once the ACA was enacted, the need for these pools were obsolete since people could get coverage even with pre-existing conditions.

Your customers will have to wait if they want to know more about high risk insurance pools. It will depend if legislation is changed and if the ACA will be repealed and/or replaced. As I write, President Trump is making modifications in the ACA.

Final thoughts…

Remember that your customers will come from different backgrounds and their familiarity with insurance concepts might vary. I’ve had customers come into my office ranging from those who know absolutely nothing to those who were very prepared. Many have done their homework. Think of this as part of your agency’s customer service so that they can understand what they are getting into.

These questions may seem obvious and easy, but to someone who is probably confused, as to how insurance works, your understanding and patience will be greatly appreciated. More often than not, I try to break down the concepts in the simplest terms to make it easier to understand.

It goes without saying that you should make them feel comfortable to ask whatever question is on their mind. Being prepared to answer these common questions can save you time and attract more insurance leads. The faster that you can put them at ease and answer all their questions, the faster you can close the deal and get them covered and prepared for life’s eventualities.