For some people, health insurance is an investment; a financial outlay to safeguard the wellbeing and peace of mind for the individual and their family. Others view health insurance as a liability; a burdensome expense to endure because of high healthcare costs. The two groups approach insurance differently, but there is one thing they both have in common: questions. Regardless of an individual’s opinion, he or she will seek answers to certain health insurance questions before committing to any policy plan.

That is understandable considering the importance and potential cost of getting health coverage. That is, however, good news for health insurance brokers. As an agent, one of your tasks is to help customers find the most appropriate policies. What better way to prove your efficacy than by addressing customer questions.

Taking a proactive approach to addressing your prospect’s concerns has numerous advantages. Doing so will help you to establish credibility, industry influence and brand exposure. What’s more, figuring out important questions to answer is not that difficult. With tools like social media at your disposal, you can quickly get a finger on the pulse of your target market, and discover relevant issues. .

In this article, we will cover the following:

- How to legally eavesdrop on your target demographic

- Addressing customers top health insurance questions

- Using groups to unravel the complexities of group Insurance

- How to leverage the power of online communities to develop loyal customers

- What to do when you can’t find suitable communities for your target customer

Figuring Out What to Answer Before Questions Get Asked

Mind reading is not a service offered by insurance agents, so it requires a little effort to figure out the answers to prospect’s questions before they ask. At this point you may be asking, why can’t I just wait until they ask a question, surely that would be much easier? Yes. You’re partly correct. It certainly could be easier and faster. However by the time someone asks a question publicly, you might have lost the opportunity to win their business.

Furthermore, many people who have burning questions never actually ask them publicly. They simply search groups and websites hoping to spot a solution to help them resolve their issue. By figuring out what answers to give to unasked questions, you can attract the attention of the silent majority.

Nowadays, most people can find answers to their insurance questions without having to contact an agent. They are using various online sources to find solutions. Most likely, your competitors are answering questions and gaining the advantage long before you have a chance to demonstrate your knowledge and expertise. It seems, in the case of insurance customers at least, good things do not always come to those who wait.

How ow do you go about solving health insurance problems before any have been expressed? One of the easiest ways to do that is to use technology to listen in on the conversations going on within your target demographic and geographic. No, that doesn’t mean crouching in your car with a high-powered microphone and recording device. You simply use platforms such as Facebook to monitor publicly available conversations. And here’s how you go about doing that:

Identify social media groups containing your ideal demographic. There are almost 700,000 groups on Facebook, according to USA Today. Some groups are open, meaning anyone can simply enter the group and start contributing; for others, you will need to send a request to the moderators to join.

Whatever the case, it is a good idea to join a few Facebook groups and begin monitoring the conversations. All the major social platforms have a “groups feature” of some type. LinkedIn, arguably the trendsetter for online social communities, has over 2 million groups, according to Ted Burris of Burris Consulting. If your target prospects are business professionals or recent graduates, LinkedIn groups could be highly beneficial.

On Google Plus, groups are not called groups; they are referred to as Communities. The format is no different from other online groups, though. People are also gathering here to have conversations on a range of topics. Google’s social platform has a balanced feel. It has both a professional and casual atmosphere.

On Twitter, groups are a little less obvious than on Facebook, LinkedIn, and Google Plus. You can still get involved in group conversations, though. The quickest way to discover a group is by using hashtags. Hashtags are essentially a way to organize conversations into groups. Head to Twitter and type a hashtag such as#healthinsurance, and Twitter will display conversations happening on that topic.

Being part of these online conversations allow you to get a better understanding of what your target prospect needs and the questions they may have. Then, you can answer their questions without them having to ask. Of course, the key is to give them assistance before your competitors.

Top Health Insurance Questions

The types of questions people have about health insurance differ between individuals.. Study your market demographic long enough, and you will likely spot a few recurring questions. Some of them get frequently asked, because they concern many in that same demographic group. At other times, the questions often show up because a satisfactory answer is yet to be provided. In either case, there are opportunities for you to step in and help.

Examples of some health insurance questions might include:

- What does health insurance cover?

- How is the price calculated?

- Do pre-existing conditions affect my premiums?

- Is my employee health insurance plan enough, or should I also supplement it through an outside provider? What are the benefits of group health insurance?

- What is a health savings account?

In groups and forums, people often ask these questions hoping to get answers from their peers. Peer power is, of course, quite powerful, but few would trade the advice of an online peer over an industry expert – especially when it comes to something as important as health insurance. If you enter the conversation with a genuine willingness to help (rather than merely to ply your services), you can instantly command a following from people desperate to get answers from experts. If for compliance sake you can’t give them specific answers to those questions, why not at least give them guidance to “compliant resource links?”

One useful avenue where you might demonstrate your expertise is the popular community-fuelled questions and answers site, Quora. This site has over 40 million users in the US (VentureBeat) and covers some 400,000 topics (Forbes). It is a site that connects people “to everything you want to know.” ’ And, every day millions of people, indeed, log onto Quora to ask questions.

Source: Andrewche.co – http://andrewchen.co/quora-numbers-2-5x-jan-growth-160k-monthly-18k-daily-actives/

How does this benefit you? Well, using Quora’s search feature, you can find specific questions related to your field. Then, provide the most comprehensive answer you can and increase your reputation in the community. Users have the ability to vote on the answers they think are the most useful and the best answers are placed at the top of the answers feed alongside the profile picture of the person who provided the answer.

Here are a few of the main benefits of using Quora.

- Gain exposure to Quora’s 40 million+ monthly users

- Build expertise and authority on health insurance

- Answer questions about your services

- Find out the questions people are asking about health insurance

Getting started on Quora is fairly straightforward:

- Create and optimize your profile

- Build a Quora page for your business

- Set up notifications to track relevant topics

- Search for the best questions to answer

- Answer questions thoroughly and with authority

This guide from Buffer describes how to get the most from Quora. It also gives helpful instructions on how to get set up on the platform – Beginner’s Guide to Quora: The Most Helpful Uses for Marketers.

Using Online Groups Effectively

A primary theme in this article is the use of established online communities to tap into conversations that are already happening. It is an effective way to offer help, build awareness of your services and find customers. But, just as if you were to join a local neighborhood group, there are etiquette items, to understand, and best practices to apply to make your time there most enjoyable. Of course, you’d also want to make the time most enjoyable for your peers in those groups by supporting its overarching mission.

Each online group you discover will likely have their own set of rules, regulations, and preferences. Some have pages outlining the dos and don’ts of the community. Be sure to read any such documents because what is permissible for one group might not be so for another. With that said, there are some common practices that should help you get the most out of your efforts, in whichever group you choose to participate.

- Do your research to ensure you select the right groups. The number of groups across all social media channels probably range in the high millions; not to mention the thousands of niche forums and online communities available. They will not all be relevant to health insurance and your agency. Many of them won’t have enough users to make it worthwhile, and lots more can be discounted as not suitable. The only way to figure out where to focus your efforts is to research your options carefully.

- Adopt a helpful attitude, rather than a sales-oriented approach. In recent years people have become averse to blatant sales approaches. That is especially true in online communities. You can, of course, promote your services but first, you must establish credibility and build trust. That is best done by becoming a genuinely helpful participant of the community/group.

- Start a group if you spot an unfulfilled need. While joining a pre-existing group is highly beneficial, there are advantages to starting your own. One reason you might start a group is that you are unable to find an already established group specifically for your target market. Creating a group allows you to direct conversation and attract the customers you want. You can create groups on Facebook, LinkedIn, and Google Plus as well as many other online platforms. This comprehensive post, from Social Media Examiner, details how to set up an online community – How to Create Your Own Social Networking Community.

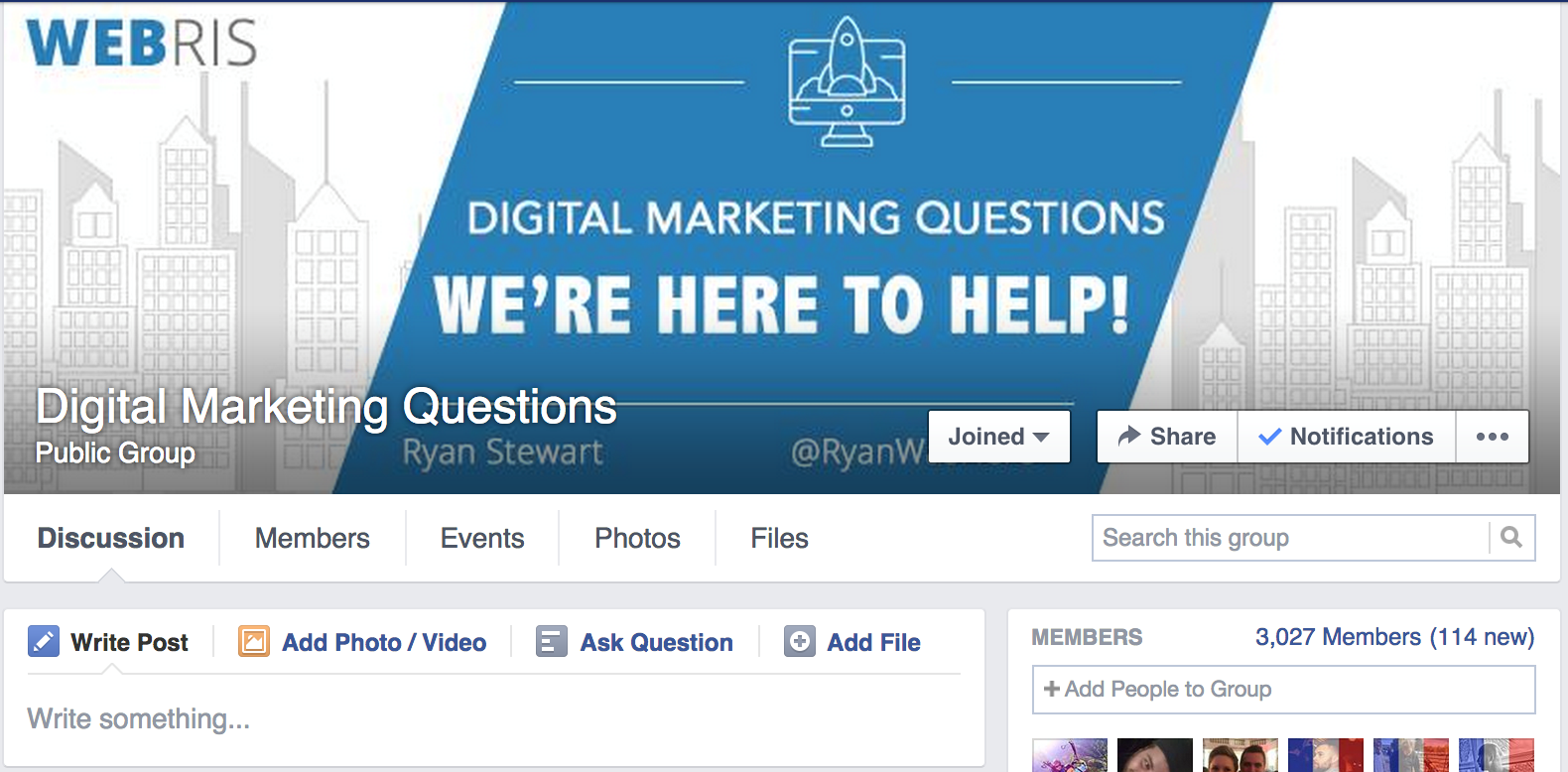

Here is a great example of a company using a Facebook group to solicit questions from their target market:

Source: Moz.com – https://moz.com/blog/how-to-build-a-facebook-group

To find groups on social media, simply type your key search words into the platforms search bar, for example, “employee health insurance,” and hit enter. On LinkedIn and Facebook, you will notice a few tabs appear underneath the search bar, one of which will be a link to groups. Clicking on the tab will narrow the search results to just groups.

On Google Plus, you will see a section on the page labeled “Communities.” There you will find all the groups associated with your search term. On all three platforms, you will see a prominent button you can click to begin creating a group.

Forums are not as popular as they once were, having been superseded by social media groups. There are still a few worth investigation, though. Here are three such examples:

Conclusion

Online communities are a great way to establish credibility, trust, and a loyal following. While there are several use cases for these communities, one of the most effective is to find and answer questions that your prospects pose. These questions often represent pain points consumers are feeling in your market, and you can provide a solution.

For example, you might specialize in employee group insurance. By finding online communities containing a group of people specifically interested in this type of insurance, you can quickly establish yourself as the go-to expert.