They say owning a home is part of the American Dream. Of course, it should follow that with owning a home, people should have homeowners insurance. Since home insurance is a necessity, most agents would think that it’s easy to write more policies and increase their homeowners insurance customers.

However, with the wide availability of policies, agents, and of course, technology, you may find it harder and harder to grow your home insurance book of business. Still, property insurance remains profitable, exceeding that of auto insurance policies. Home insurance, as well as other types of policies that could be bundled with it (Personal Article Floaters, Flood Insurance and Earthquake Insurance), could become a key part of your book.

How can you increase the number of homeowners insurance customers in your book of business? This blog post gives you some tips and techniques which include:

- Follow-up sequence

- Targeting first-time homeowners, Upselling and Cross-Selling

- Providing Useful Information

Intrigued? Read On!

1) Follow-up multiple times

You’ve done your rapport building, did your fact-finding, made your value presentation, overcame all of the prospective customer’s objections, but she still hasn’t agreed to become a new customer of your agency. You think she’ll call you back, but she never does. Have you played that “waiting game” before? Of course, we all have played that game. What’s the best approach for those prospects that still seem to be sitting on the “proverbial fence?”

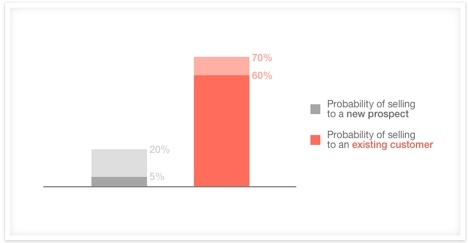

Consider this statistic from Hubspot:

Source: Hubspot, accessed via https://blog.hubspot.com/sales/sales-statistics

Yes. You’re right. Follow-up is the key. Not just follow-up, but your team needs to follow-up a minimum of five times before moving on to greener pastures. The devil is in the details on this follow-up strategy. No matter the type of CRM (Customer Relationship Management) software you’re using, your team has to follow-up. Every CRM has numerous approaches for following up with prospective customers. Many agents continue to buy expensive internet leads, but they may have 5,000-10,000 leads already in their CRM that have yet to be called even one time, let alone five times.

When I use the term “called,” I mean called, emailed, texted and/or direct mailed. Many of the top agents agree that using multiple touch points is the most effective way to close the highest percentage of leads you’re generating. According to Hubspot, 44% of people give up after the first follow-up. Perhaps, you don’t want your sales team to be viewed as “one of those pushy sales people,” but that’s a lot of money you’re leaving on the table if your team simply gives up after the first try. It’s all about “being pushy, diplomatically.”

Don’t think you’re annoying, especially if this is your team’s first follow-up after their last contact. After all, people get busy and may forget about what they’ve talked about. We all have responsibilities – work, spouse, kids, family, hobbies, etc. It may simply be that your prospect has had an emergency or has been caught up in their own hectic schedule. Like the old-school advertising saying that, “People have to see an ad at least 7 times before they respond,” most people (80%, as per the graphic above) require at least five follow-up contacts to be moved properly through the buyer’s journey.

The lesson here is don’t give up easily. Unless you get a flat and outright “no, and don’t contact me again,” follow-up with a prospect at least five times before moving on.

Here are some ideas on how you can follow-up:

- Send a friendly email or text message asking them if they have made their decision or if they have any further questions (remember, in many states, you need their approval for text messaging).

- Offer to send them brochures and other free information

- Forward an interesting article (related to your follow-up)

- Tell them about a recent customer story (“Customer X recently had a burglary in their home and we were able to help them by doing Y and Z…etc.”)

{{cta(‘d5cfd355-e14a-4ec0-bb24-9685ce785785′,’justifycenter’)}}

2) Target First-time Buyers and New Homeowners

This should be a no-brainer, but have you ever thought of specifically targeting new homeowners? Sure, there are tried-and-true methods of finding home buyers. For example, partnering with real estate agents or advertising in local, real estate magazines and websites; however, have you really sat down and thought about looking at who’s buying homes these days and targeting them specifically?

First-time homebuyers are getting younger and younger, and right now, we’re seeing an increase of Gen Y and Millennial buyers, especially older members of this generation. The older Millennials are climbing the career ladder and finding themselves married with kids and looking to settle down. Buying a home is a logical “next step” in this process.

Source: Agency Nation accessed via https://www.agencynation.com/how-to-sell-insurance-to-millennials/

According to a NAR (National Association of Realtors) Survey, “the largest group of recent buyers was the millennial generation, those 34 and younger, who made up 32 percent of all buyers (31 percent in 2013) the largest group of recent buyers was the millennial generation, those 34 and younger, who make up 32 percent of all buyers (31 percent in 2013).” In fact, the survey further states that most Millennials now find owning a home more practical than simply renting.

So, now that you know who your new home buyers are, how can you find them? Now, we may say this over and over again, but the best place to find Millennials are online. Consider this:

Source: D Lucas Realty, accessed via: http://www.dlucasrealty.com/21st-century-real-estate-customer

So, if people are searching for their homes online, it makes sense that they would also be looking for their home insurance online.

Developing a solid online presence will give you the most cost-effective opportunities for consumers, who are shopping for homeowners insurance, to find you. . Of course, it’s not as simple as having a website. You must build your presence and become easily accessible through various online channels, e.g., Google (both Organic and Google Maps), Bing Network, Yahoo, Facebook Business Page, LinkedIN profile, Twitterr, Google+, Yelp and other important, online business directories (most voice search applications will also source online business directores to help them serve up the most relevant voice search results). It’s critical that you be found on the soon to be ubiquitous voice search applications that have really improved their accuracy and speed of late.

Today, it’s almost impossible to be successful without any type of web presence. In fact, many people (Millennials, especially) may find it suspicious if you don’t have an effective, digital footprint. So, it’s time to take your online marketing to the next level, so you can write more home insurance policies.

3) Cross-Sell and Up-Sell to Other Clients

Cross-selling is, ironically, both the easiest and hardest thing to do for many agents. After all, if you already have a healthy book of business, then that means your team has plenty of cross-selling opportunities. When was the last time you did a thorough analysis of your current book to determine where the “gaps” lie in your customers’ coverages? Many “Rock Star Agents” are quick to tell you that “Multi-Lining” is one of their biggest secrets to success.

Do you have a system in place that will tell you who, in your book, hasn’t had an “IFR” (Insurance and Financial Review) in the past 6-12 months? Many of our clients, those in the aforementioned “Rock Star” category tell us that they have a system that will not allow a customer to go past that 6-12 month period without doing an IFR (many may be done by phone, but they tell me that ideally, they see the best results during face-to-face IFR sessions). Most of their biggest “Multi-Line” sales have come as a result of uncovering various needs that almost always occur between IFR sessions.

How can you cross-sell smartly? Well, before people become receptive to your message, you need to listen them talk first. Some “Rock Star Agents” call it “Needs Analysis,” “Fact-Finding” or “Needs Based Selling.” Whatever you call it, it means the same thing. Of course, there are open and closed-ended questions that we’ve all learned from our sales 101 courses. More advanced sales professionals will integrate “Reflective Questions” that allow you to go much deeper into given responses that your team receives from customers in your book.

Novelist and poet Marge Piercy put it best when she once said, “If you want to be listened to, you should put in time listening.” Coaching your team on how to listen to the customers in your book, during these IFR sessions is paramount to building the rapport necessary to write more homeowners policies. Good CRM software will allow your team members to keep good online notes that allow them to review before each IFR session; it makes them more efficient, effective, professional and personable.

Some of the smallest requests, from your customers, could allow your team to pivot to a conversation that may allow them to fill one, or more, of their needs. Coach your team to listen carefully to each and every request customers make. More often, than not, “there’s gold” in those requests. For example, a change of address request may mean several, new needs that may require one or more of your products, or services, to satisfy–did they buy a new home, did they rent a bigger home, are they planning for a bigger family, or does their new zip code mean savings (auto coverage) that could help them subsidize additional life insurance they need? Or perhaps you’re out and about, enjoying your Saturday afternoon, and you run into a customer who tells you they’re about to get married or have a baby – perhaps they’re also looking at new homes and need a more comprehensive policy. Many of life’s major events trigger changes, prompt people to buy a home or upgrade their existing home. In such cases, it’s highly likely that their insurance needs have changed, also. .

Of course, don’t waste the opportunity to upsell too. Maybe you have an existing customer who’s about to propose to his or her significant other – perhaps they should consider jewelry insurance or personal property insurance. You might have clients who have college-aged children about to rent apartments – have they thought about renters insurance? And, in the event of an impending disaster, many states allow for flood insurance policies to be placed into effect sooner than the 30-day window under a few circumstances:

- If the flood insurance was purchased within 13 months of the revision of the flood map affecting the area.

- If the flood insurance was bought in connection with the making, increasing,

In such cases, your customers may not even know about such exemptions, and you can prompt them to increase their coverage in either event. They will probably thank you for it, especially if disaster strikes.

If you operate in an earthquake zone, how many of your customers believe that their traditional homeowners insurance policy will rebuild their home (in the event of a devastating earthquake)? Even the California Earthquake Authority is presently running TV commercials that better educate homeowners, in the state of California, on this topic. They’re directed here: https://www.earthquakeauthority.com. Think of the value your agency can provide by ensuring that every customer, in your book, understands the importance of acquiring a separate earthquake insurance policy. They’ll no doubt thank you later!

4) Provide Useful Information

Many buyers today are used to having information at their fingertips. After all, most of us carry around this supercomputer in our pockets that can answer almost any question imaginable. This level of access to information has spoiled us, and in turn, we expect sales people, who provide insurance products and services, to “know-it-all.”

Gone are the days when sales people (including insurance agents) can withhold information in exchange for a meeting or contact information. Many prospective insurance customers (especially Millennials) will have already done much of their own research, online, before they ever call your office; it’s a part of the “Buyer’s Journey” that my team and I frequently write about.

According to a study by Accenture, “68 percent of all Millennials demand an integrated, seamless experience regardless of the channel. That means being able to transition effortlessly from smartphone to personal computer to physical store in their quest for the best products and services.”

So, it’s not just about giving them accurate, and speedy, information online, but it’s also making it a “seamless” experience. While you may reach out to them virtually, many buyers today still want that personal touch, and that’s where insurance agents can really shine. After all, you don’t just sell the paper that their policy is written on. What you’re really selling is the security and service you provide for them and their family. In the event of a natural disaster at their home, they want to know you’ll be there. They want to know that you are looking out for their best interests, especially when they need you most.

Aside from merely providing information online (as much as compliance rules allow you to), you also need to have that personal touch. Follow up with them personally if they leave you an email or message on your website, social media or Yelp account. Although consumers today want their information now, when it’s time to sign up for a policy, then they would prefer to know that they’re talking to an actual human.

You don’t have to provide only quotes and prices online (in fact, you might not be able to, depending on your company and state’s compliance rules). However, you might want to consider providing other useful information. Providing compliant, approved “Tips and Advice” for everyday living can be essential ingredients to making that connection and building that bond between consumers in your community and your agency. You don’t have to wait to get a question, but rather, you can immediately send out answers. Here are some examples of things you can do:

- Share or retweet relevant articles and tips to your social media followers. Use a service like Google News, Google Alerts, or Feedly, to find compliant, relevant and newsworthy articles online.

- Tweet out or create status updates that offer useful tips. You don’t even have to use tips that are related to insurance. In fact, Hubspot recommends that 75%-80% of your content be “non-product specific.” You can share tips on home maintenance, road safety, exercise tips, pet care and cooking advice that people may find interesting.

- Consider creating graphics with useful information. People today want bite-sized clips of information they can digest easily, not long, winding technical articles. Photoshop or a web-based app like Canva can help you create beautiful and shareable graphics.

- If you’re a non-captive agent, then consider adding a blog to your website. Blogs are a great way to create dynamic content on your website (which search engines love), but it provides a great platform for you to talk to your readers and prospects. You can write articles (or have someone knowledgeable write them for you) that address people’s concerns or questions. The great thing about this is it instantly gives them the information and answers they need, without having to search further or call you.

Aside from anticipating people’s questions, sending out tips and information can help build your reputation as a go-to agent in your community and make you top of mind for your potential customers when the need arises. .

Is it Worth It to Increase Homeowners Insurance Policies ?

Many agents consider home insurance a loss leader – something that will bring in new customers, but not really a product that can make them a big profit. Sure, that would be one way to think about it, but what’s your goal? Is it to increase monthly profit? Grow your sales? Write more homeowners policies than your peers? Do you wish to reduce your overall “lapse-cancellation” rate? Shelter is what every family needs and desires. Homeownership is also a goal, or dream, of most families in America. An excellent way to grow your book is by helping consumers in your community achieve homeownership. Once they have achieved their dream of homeownership, let’s help them protect that asset.

Many homeowners insurance policies make those customers very sticky to your agency. They’re much less likely to leave you because of a few dollars price difference at another provider. Most “Rock Star Agents” understand that homeowners insurance, and commercial policies, are great ways to build tremendous stability in your book of business. They spend a great deal of time, and money, perfecting the art of writing more homeowners and commercial policies. Why shouldn’t you?

{{cta(‘d5cfd355-e14a-4ec0-bb24-9685ce785785′,’justifycenter’)}}