Consumers’ needs are constantly changing depending on what is happening in their lives. A life insurancepolicy customer could need car insurance for his kid or boat. Unfortunately we can’t foresee the future to determine what people will want or need. It is important to be vigilant and identify selling opportunities for writing additional insurance coverage and increase profitability for your agency.

In this post we are going to cover how to identify consumers who need additional coverage:

- Working with existing customers

- Dealing with new customers

- Keeping in touch with customers

Where to Start? With What You Have

Insurance agents are constantly on the lookout for new customers, but let’s not forget about our current book . Since you already know and offered insurance to them, it is easier to jump on a call and touch base. This will definitely up the ante on your customer service too.

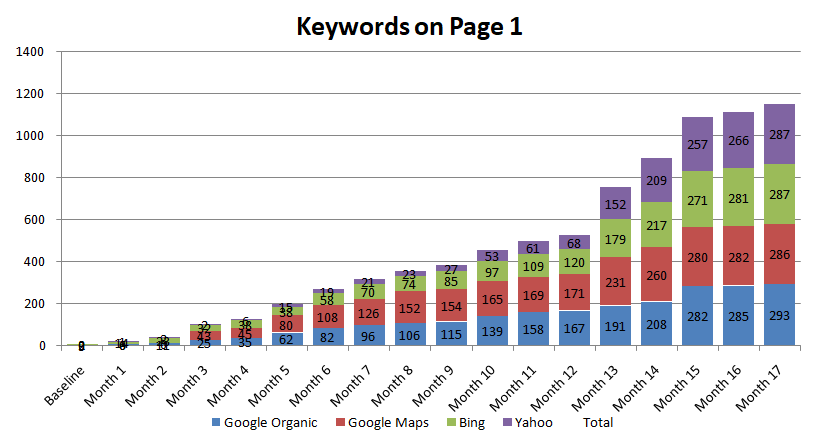

Take a look at this graph from the book Marketing Metrics :

SOURCE: https://www.groovehq.com/support/upsells

You are most likely to sell additional kinds of insurance to current customers. And it totally makes sense, so take out your rolodex (for those of you that still have one!) or contact list and take a look at your customers. You are going to have to block off some time, roll up your sleeves, and make a list of which of your customers you should contact. I like to do this every six months or so, as you never know what kind of life changes your customers may have gone through.

Here are things that should go on that list:

- Client information – name, birthdate, occupation, and their current policies

- Family information – the number of people in their family, birthdates

- Life events – marriage, births, deaths, illnesses, new home, kids off to college

- The types of insurance that could be offered for a cross sell

What should be in the list is basically anything that will help you identify what policies to offer to them. Feel free to add more information that will make the process easier for you.

You should also make sure that the information in the list is also in each (current and future) client’s file so you can readily access it. This way when anyone pulls up their information they can identify what products to offer.

Should I Do a Hard Sell?

No one likes a pushy salesperson and the same goes for insurance agents. I’ve always said, “When you properly educate a prospect, or customer, you allow them to buy. You won’t have to sell them.” Once you are meeting in person or talking on the phone, do not rattle off a list of products you think the client should buy. They already know that you two are going to talk about policies. Pleasantries are in order and you should ask them about what has been happening in their lives since the last time you talked.

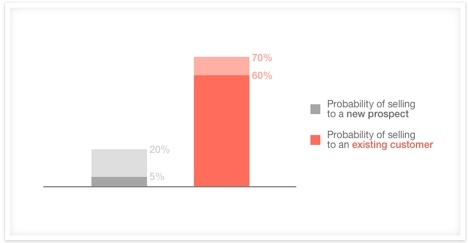

SOURCE: http://www.gallup.com/businessjournal/169301/time-insurance-carriers-win-customers.aspx

Make sure to listen to what they tell you…

- You will be able to discern what they need

They may have a daughter or son that is entering college so this may be the right time to offer renter’s insurance - Put your client’s needs first

Tailoring your pitch to their current situation is more important and builds goodwill.

I’ve studied, and used, numerous “sales tracks” over the years, but this is my tried and true favorite:

- Research your prospect/customer

- Build rapport

- Needs analysis

- Value presentation (tied to #3)

- Overcome objections (They’re buying signals)

- Close (Write the new policies)

- Ongoing customer care (Delight your customers, and they then become your evangelists)

What I mean by this is to take mental notes during the chat. Or take real ones – I also keep a pen and pencil handy when I’m talking to someone on the phone. They may have plans to buy an RV or a motorcycle for a road trip. Just like that you can offer motorcycle or RV insurance. Lately I’ve shifted to typing my notes right into by electronic contact card in my CRM (Customer Relationship Management). I’m finding that it’s much less likely for me to lose them, and I can access my notes from the cloud through my smart phone from wherever I happen to be located.

You could mention other products that you think they may need in the future just to put it out there. A strong value proposition is to mention a statistic from your carrier – such as, “30,000 of our customers have this particular policy, and here are the reasons why they have purchased it, and here are the reasons why. You’re certain to experience the same benefits.” It’s a confidence builder for your customer.

Policy change triggers

In the event that a client contacts you and asks about discounts or has questions about their policy, make sure to cross sell. I had a friend that got in touch with his agent to ask about health coverage for his newborn baby. The agent confirmed that he could get a multi-policy discount on his coverage, and that was it. When I heard about this I thought what a missed opportunity to cross sell and offer life insurance for the new father. New home buyers, college-bound kids, new parents, new graduates are just some of the people who may contact you, so make sure you find an opportunity to cross-sell where you can.

Policy reviews

Never miss the opportunity to write more policies and continue to build your book. ! The yearly policy review is not just for the policy that your customers have. It goes without saying you should be armed with a list of suggestions for what you think your customers need.

While talking to the client, remember to…

- Ask for referrals

- Towards the end of the conversation go through a quick list of insurance that you offer

- Remind them of renewal dates

Since you have a captive audience now is the time to get a couple of numbers. It’s always a good sign if current customers recommend their insurance agent. It may be a leg up with snagging their friend or relative as a client too. Which brings us to…

How Can I Engage New Customers?

Laying the seeds for writing future business is of utmost importance right at the beginning of your relationship with your new client. You can even joke about it and give them a warning,”I’ll be in touch soon to bug you about this other line of insurance” or something along those lines.

No matter your method just bring up all the other products you offer so that they know. It may be the case that they or someone they know will need insurance, and you will be top of mind. Feel the room and don’t worry about making the cross sell right then and there. Just talking about it may lead to additional policies being written.

Remember you are gathering information for the quote anyway, so ask all the questions you can!

Collecting x dates

You may meet someone who already has an existing policy. Don’t write them off just yet. Ask about their policy and when it will expire. X dates or expiration dates are good to know, so that you can get in touch with the client before the end of their current policy to give them a competitive quote.It’s all about share of field, share of mind and share of time

They may not be interested at the moment. By asking for the x date you are showing the client that you can wait (i.e. be patient) and respect their needs. But when the time comes you are going to allow them to take advantage of your products and exceptional service. .

Start with renter’s insurance

This is one of the easiest things to offer, because it is inexpensive; most people need it, and it can help them qualify t for a multi-policy discount.

Know the lay of the land

Let’s say you work in Florida and just got a client that is a new home buyer looking for insurance. You could suggest that they consider getting a wind mitigation inspection. This type of inspection is recommended in coastal areas where windstorm damage or loss is a concern – think about tropical storms or hurricanes that damage or level houses, like Irma.

Wind mitigation inspection is not required by law and is not part of the standard four point home inspection (electrical, HVAC, plumbing and roof). It may not be needed, but it is a great suggestion because it can save your customers money! Doing the inspection, more likely than not, will result in a lower insurance premium. On average the discount amounts to 30% which could equal a couple of hundred to $1000. More savings = happy customers!

What are other things can you do to find new customers?

- Make a product list

Create a flyer with all the products you sell, and give it out when meeting with customers. It can be a simple checklist to show customers to make them aware of all the products you offer. It’s probably a good idea to add that list to your website or talk about it on social media. - Designate a cross selling day

Plan ahead to call customers and stick to it. - Use social media

Promote your lesser known insurance lines of insurance on social media. Your customers should already be part of your followers, so it is an easy way to promote your products. - Keep cross selling

You may not write the business today, but you might the next time around.

If you happen to work at an agency with a team of people, choose someone to be the “Cross Selling Head.” Instead of having to nag everyone yourself, delegate and have someone keep track of cross selling activities. If you give them a little commission from all the additional policies, it will be incentive enough to encourage cross sells. Speaking of commission, suggest a higher rate for additional policies and that should get everyone on the cross selling train.

http://www.gallup.com/businessjournal/169301/time-insurance-carriers-win-customers.aspx

Should You Constantly Keep Up with Your Customers?

To build a relationship with your client and make them feel that they are being taken care of, you should be in contact with them throughout the year (and not just during policy review time.) Greet them during holidays, shoot them an email, etc. This is a good way to keep them informed on what you can offer them.

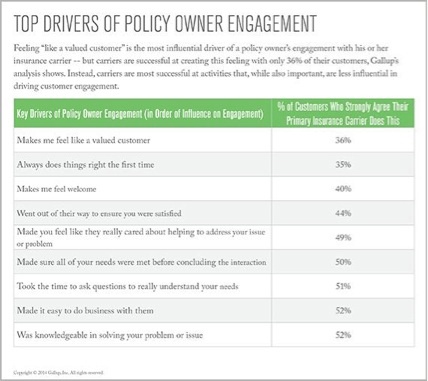

The bottom line is that if you have regular check-ins with your customers, you will know or be able to foresee their needs. And that will have a positive effect on your business. Believe it or not only 34 percent of customers say they are fully engaged with their insurance agents. Needless to say there is a lot of potential to grow your business while keeping your customers happy.

To drive home the point on what insurance agents should do, the study recommends:

- Make it a point to have high-value conversations

You can start with money and policy savings, but definitely ask questions about how your client is doing. Your customers should feel like you genuinely value them. - Do things right

One of the main customer complaints is that things aren’t always done right the first time. In a way it shows that the agent was not listening to the customer’s needs. It is all about customer service, so we should always strive to get it done right, the first time. - Know your product and client

There are so many insurance options out there, and you need to differentiate yourself. Listen to your customer’s needs and know how you can help them with your products.

It all comes down to one thing (ok, a couple of things)

Whether you turn to your existing customers or find new customers, you have to be willing to put in the time to know what they need. Armed with this data you can make informed decisions on how to approach the client and sell additional coverage.

It may seem daunting if you are just starting out and have to go through your client roster, but just always remember to think about upselling during your initial meetings. Then it will become second nature. That coupled with great customer service should result in more profits and happy customers!