The insurance claims process can make or break your relationship with a client. During this time, they are decidedly vulnerable, highly stressed, and probably quite desperate. Clients are looking for agents and insurance companies for reassurance and solutions. Insurance agents can come in really handy during this critical experience, by acting as trusted advisors, experts, and intermediaries.

It may come as no surprise to learn that your insurance clients are generally skeptical about the claims process. No doubt, many have heard stories of complex paperwork to fill out, time-consuming delays, and some insurance companys’ reluctance to pay out. Those infrequent, yet highly publicized, occurrences only serve to heighten anxiety on the part of claimants.

You can alleviate those fears by helping to smooth the path towards a successful claim. In turn, you will cultivate long-term customers who spread the word about your agency and their positive claims experience.

Understand the Insurer’s Claims Process

Policyholders seldom take the time to come to grips with an insurer’s claim process: until they need to make a claim, that is. At that time, in addition to coping with whatever crisis has befallen them, the client also has to get to try and grasp the finer points of insurance claims. That, of course, adds to the stress of the situation and is a major pivoting point on their perception of the whole experience.

That is an important area where agents can provide valuable support to clients. They will need help with things like contacting the insurance company, organizing the necessary information, and ensuring that proper notification is sent out to third parties if required.

While the claims process usually proceeds in predictable steps, it does not always appear as straightforward to the claimant. They will expect you, the agent, to have a thorough understanding of their claims and thus be able to facilitate a quick and painless settlement.

The Fountain of Advice

Sometimes a client will come to you when a claim is not working out to their satisfaction; other times, it might be because they have multiple claims and are unsure how to proceed. Whatever the reason, you will have to be the fountain of knowledge in all matters related to making insurance claims.

You may need to go over a client’s specific situation and give advice on whether or not to file a claim, offer advice as to the best course of action if a claim is not going well, or help the claimant to handle multiple claims. Whether or not a client purchased their insurance policy through you is inconsequential. At the time of making a claim, they will look to you to as the trusted source of advice to guide them through to a satisfactory outcome.

Resolve Miscommunication Issues

Insurance companies generally maintain a smooth claims process. But, nothing disrupts that process quite as much as miscommunication. There are numerous reasons why breakdowns occur: client negligence, a sales executive unintentionally skipping a point in the original quotation, or an overly complex quotation structure that was not previously communicated accurately.

That is all before we get to the actual claims process. Here, it is very easy for miscommunication to occur between the insurer and the claimant as both parties seek to resolve the issue to their own satisfaction. It is not possible for insurance agents to eliminate all issues related to miscommunication. But, much can be done to alleviate many of the problems associated with poor communication.

Helping clients to understand their policy and the steps in the insurance claims process will go a long way to resolving many of the issues. As people are often in a volatile state during this time, it is easy to misread or misunderstand some part of the process or policy, and that will lead to miscommunication. Where possible, you should act as an intermediary for all documents shared between insurer and claimant.

Utilize Digital Channels

The internet is one of the first places that people turn to solve problems these days. That is a cause for dismay amongst some in the insurance and financial services industries. The popularity, and helpfulness, of digital channels, however, should be cause for some excitement. One reason for that is because it allows you to add greater value to a client’s experience without taking on extra work for yourself.

You may have noticed that customer expectations have shifted over the past decade. So much so that manually meeting their expectations has become almost impossible. Not only do people demand a personalized service, they expect it to be available at any time and place. Meeting these demands means digitizing some of your processes.

The use of digital channels allows you help more clients through the claims process in less time. You can, for example, refer clients to a pre-vetted, compliant, list of websites that has answers to common queries. That would eliminate time spent answering the same questions from new claimants, allowing you more time to focus on areas where your human skills are needed.

Treat Each Claim as if it Were Your Own

Although consumer trends, across the board, steer towards digital being the go-to source for almost everything, in the insurance and financial services industry, people still appreciate agents. Thankfully. Agent penetration in the commercial, life, and homeowners verticals is 99%, 99%, and 94% respectively, according to TechCrunch.

Clearly, people still need that one-on-one, personal approach that agents do so well. But that does not mean things will always stay the same. Indeed, agents are in a constant battle to stay relevant. One way to demonstrate the value agents provide is to maintain a high level of personalized service.

When a client comes to you for help with a claim, treating the claim as if it were your own will help you to achieve a level of service that people admire. That means going above and beyond to contact the necessary people, file the required documents, and following up, if needed, on your client’s behalf.

Conclusion

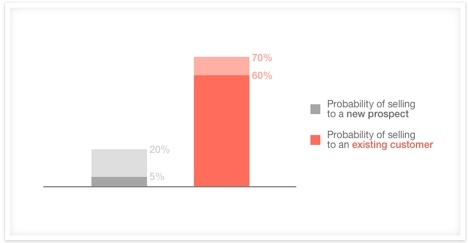

From homeowner’s insurance claims to financial advice, insurance agent services are still very much in demand. These days, however, it is important to go above and beyond the call of duty in your efforts to satisfy clients. By taking steps to ensure that the insurance claims’ process is a smoother experience for your customers, you will help to preserve the good reputation of agents and the industry as a whole. Also every successful agent knows the importance of building their book of business primarily via referrals, word-of-mouth and repeat clients.