Raising policy rates is a common practice for insurance carriers, but it can often lead to customer dissatisfaction. Many clients view rate increases negatively, which can pose significant challenges for agents. Therefore, it’s crucial for insurance professionals to have effective strategies in place to manage these situations and ensure they retain their clients.

In this article, we’ll discuss practical strategies that insurance agents can use to navigate policy rate increases while building trust and delivering value to clients.

Key Takeaways

- Proactive Communication: Clear, timely communication is crucial when raising policy rates. Explain the reasons behind the increase and maintain transparency to build trust with clients.

- Offer Value-Added Services: Providing additional services, such as policy reviews or exclusive resources, helps clients see the value in their policies and accept higher premiums.

- Personalized Solutions: Tailoring insurance solutions to individual client needs justifies rate increases and demonstrates that the service is custom-fit for their unique situation.

- Loyalty Programs and Discounts: Offering discounts and loyalty rewards encourages long-term clients to stay, reducing the likelihood of them seeking cheaper alternatives.

- Enhanced Customer Support: Excellent customer support, with easy access across various channels, strengthens relationships and ensures clients feel supported during times of financial change.

These strategies will help insurance agents retain clients despite rising policy rates by focusing on building trust and offering value.

1. Focus on Proactive Communication

Raising policy rates is never welcome news, and it needs careful handling. That’s why clear, timely communication is essential. Insurance agents must proactively explain to clients why rates are increasing and how it affects their coverage.

By communicating openly, you demonstrate transparency and build trust. Explain the factors driving the rate hike, such as changes in claims trends or regulatory requirements, and assure clients that these adjustments are necessary to maintain comprehensive coverage. It’s also beneficial to remind clients that occasional rate increases are standard across the industry.

2. Provide Value-Added Services

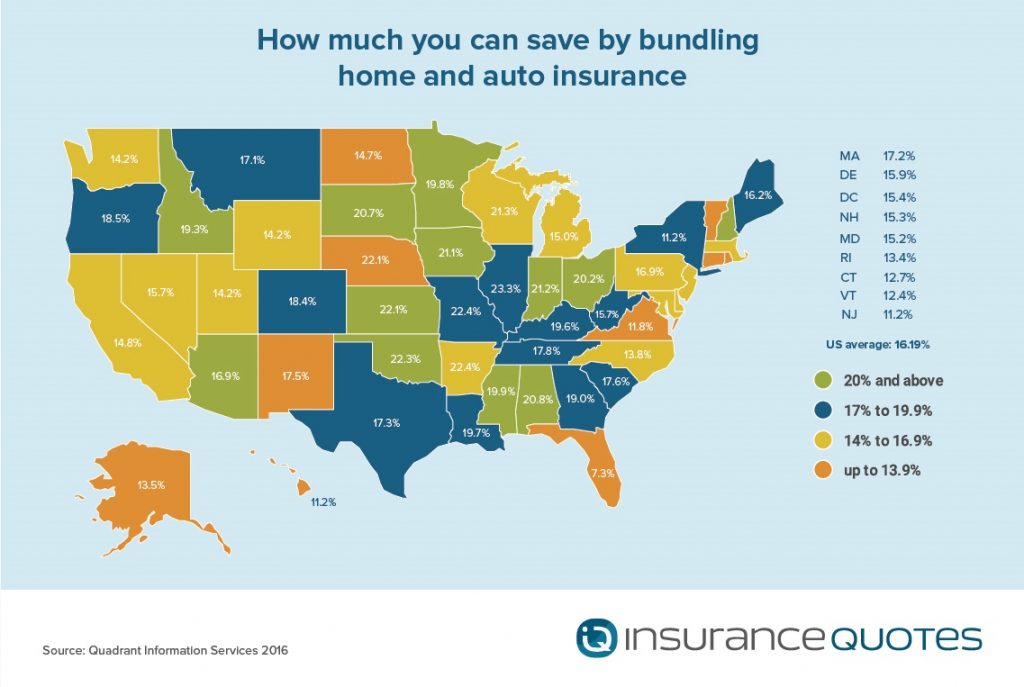

Clients are more likely to accept higher premiums if they perceive added value. Offering value-added services such as access to exclusive resources, policy reviews, or bundling options can make the higher costs feel justified.

These services not only enhance the client experience but also provide a tangible reason for the price increase. By focusing on the additional value clients receive, you can mitigate their concerns about rising costs.

3. Offer Personalized Solutions

Every client has unique needs, and offering personalized solutions can help justify the increase in policy rates. Tailoring insurance products to meet individual client requirements demonstrates that you understand their specific circumstances, making them more willing to pay for a service that feels custom-designed.

Be clear about how personalized solutions can require additional costs, and highlight the benefits clients gain from a tailored approach to their insurance coverage.

4. Implement Loyalty Programs and Discounts

Discounts and loyalty programs are powerful tools for retaining long-term clients. Customers appreciate financial incentives, and offering discounts to loyal clients can reduce the likelihood of them seeking cheaper options elsewhere.

By rewarding long-standing customers with loyalty perks, you not only show appreciation for their business but also encourage continued engagement, making it less likely they will switch to a competitor.

5. Enhance Customer Support

Strong customer support is crucial, especially when clients are dealing with rising costs. Clients should feel they have easy access to help whenever they need it. Whether through phone, chat, or email, ensuring timely and effective customer support strengthens client relationships.

During periods of financial strain or uncertainty, the quality of your support can make a significant difference. Address client concerns quickly and efficiently, ensuring they feel valued and supported at every step.

Final Thoughts

Managing an insurance business comes with its challenges, and raising policy rates is one of the toughest. However, by focusing on strong client relationships, clear communication, and offering additional value, insurance agents can successfully navigate these challenges.

Following these strategies will not only help you manage policy rate increases more effectively but also improve customer retention and satisfaction.

If you need assistance marketing your insurance agency, contact us today to schedule a consultation with our digital marketing team that specializes in helping insurance agents grow their business.

Frequently Asked Questions (FAQs)

Why do insurance agents need to raise policy rates?

Insurance agents raise policy rates due to factors such as increased claims, regulatory changes, or shifts in market conditions. These adjustments help ensure that clients continue to receive comprehensive coverage.

How can I prevent clients from leaving after a rate increase?

The best way to retain clients after a rate increase is through clear, proactive communication. Explain why the increase is necessary and offer additional value, such as personalized solutions, loyalty programs, and enhanced customer support.

What are value-added services, and how do they help with customer retention?

Value-added services include extras like policy reviews, bundling options, or access to exclusive resources. These services provide additional benefits to clients, making them more likely to stay with your agency despite higher costs.

How can loyalty programs help retain long-term clients?

Loyalty programs reward long-standing clients with discounts or perks, encouraging them to remain with your agency. These programs show appreciation for their business and help reduce the chances of clients switching to a competitor.

Why is customer support so important when policy rates increase?

During times of financial stress, such as a policy rate increase, clients need reassurance and prompt assistance. Offering fast, efficient customer support helps resolve concerns and reinforces trust, making clients feel valued and supported.

How can personalized solutions justify higher insurance rates?

Personalized solutions are tailored to meet individual client needs, offering a more customized experience. Clients are often willing to pay higher premiums for coverage that specifically addresses their unique circumstances, which can justify rate increases.

What’s the most important strategy to follow when raising policy rates?

The most important strategy is maintaining proactive and clear communication with clients. Transparency helps build trust, making it easier for clients to understand and accept the reasons behind a rate increase.

This article is a collaboration between Carl Willis and OpenAI’s ChatGPT. Created on September 16, 2024, it combines AI-generated draft material with Willis’ expert revision and oversight, ensuring accuracy and relevance while addressing any AI limitations.