In the competitive world of insurance, the ability to persuade and convince clients is not just a skill; it’s an art form. Insurance agents face the unique challenge of selling a product that is intangible and represents a promise more than a physical good. This makes the art of persuasion crucial to not only close sales but to ensure clients feel confident and secure in their decisions. Here, we delve into effective strategies that insurance agents can employ to master this art, build trust, and foster long-lasting client relationships.

Understanding Client Needs

The foundation of persuasion in insurance sales lies in understanding the client’s needs. A deep understanding of what motivates your clients, their concerns, and their aspirations is crucial. Start by asking open-ended questions to get them talking about their expectations and fears regarding insurance. This approach not only provides valuable insights into their needs but also demonstrates empathy, building a rapport that is essential for persuasion.

Educate, Don’t Just Sell

Education is a powerful tool in the insurance industry. Many clients may not fully understand the intricacies of insurance policies, which can lead to hesitation and distrust. By taking the time to educate clients about the benefits, terms, and conditions of different insurance products in a clear and understandable way, agents can demystify insurance and make clients feel more comfortable with their decisions. This approach positions the agent as a trusted advisor rather than just a salesperson.

Highlighting the Value

One of the most effective persuasion techniques is to highlight the value that insurance can bring to the client’s life. Instead of focusing solely on the features of an insurance policy, translate those features into benefits that solve problems or enhance the client’s well-being. For example, discussing how a life insurance policy can secure a family’s future financially is more impactful than simply listing policy features.

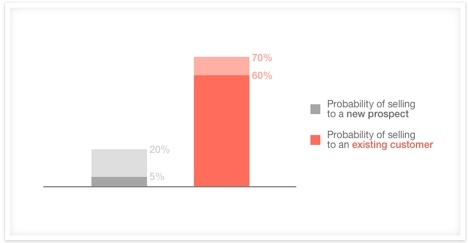

Leveraging Social Proof

Social proof, such as testimonials from satisfied clients or data showing the popularity of a service, can significantly influence potential clients. Sharing success stories or case studies where insurance has made a substantial difference in someone’s life can be very persuasive. It helps to alleviate fears and uncertainties by showing real-life examples of the value and security that insurance provides.

Creating a Sense of Urgency

Creating a sense of urgency can motivate clients to act. This doesn’t mean pressuring clients into making quick decisions but rather highlighting the importance of being proactive about their insurance needs. Discussing the risks of delaying insurance coverage and the peace of mind that comes with having protection in place can help clients move from contemplation to action.

Personalization

Tailoring your approach to each client’s unique situation and preferences is key. Personalization in communication shows that you’ve listened and crafted a solution that fits their specific needs. This bespoke approach can significantly enhance the persuasive power of your message, making clients feel valued and understood.

Building Trust

Ultimately, the most effective persuasion strategy is to build trust. This involves being transparent about policies, including costs and potential downsides. It also means following through on promises and being available to answer questions and address concerns. Trust is the cornerstone of any lasting client-agent relationship.

Conclusion

Mastering the art of persuasion is essential for insurance agents aiming to convince clients effectively. By understanding client needs, focusing on education, highlighting value, leveraging social proof, creating urgency, personalizing the approach, and building trust, agents can enhance their ability to persuade clients. These strategies not only help in closing sales but also in establishing a foundation of trust and credibility, leading to long-term relationships and ongoing business success.

Insurance agents who refine these persuasive techniques will find themselves not just selling policies, but providing a valuable service that clients appreciate and depend on. The goal is to ensure clients feel informed, valued, and secure, knowing their insurance choices are in the best hands.

This article is a collaboration between Carl Willis and OpenAI’s ChatGPT. Created on February 5, 2024, it combines AI-generated draft material with Willis’s expert revision and oversight, ensuring accuracy and relevance while addressing any AI limitations.