Selling more auto insurance policies has always been tricky for many agents. While it’s true that most states in the US require drivers to have minimum levels of insurance, that doesn’t guarantee those additional policies will be written by your sales team. In the minds of many consumers, car insurance has become a commodity.

Many see this as a product that’s interchangeable and therefore, they often go for the “State Minimums” at the most affordable prices. This, of course, poses a problem for agents: how can they stand out from the market and increase their auto policies when customers perceive their products to be the same as everyone else’s?

Now more than ever, insurance agents need to be flexible and offer more than their competitors. An increase in auto policies and long-term, or repeat, business is something all agents strive for, but how can you achieve that in the current market conditions?

In this blog post, we’ll cover a few basics on what you can do to increase your auto insurance sales, namely:

- Establishing your online presence

- Targeting the right customers

- Cross-selling

- Providing Added Value

1) Establish your online presence

You’ve probably heard it all before, but having an online presence is important for anyone who does business these days. But, you might be thinking that you’re not selling books or electronics or other physical items–why would you need to be online? Well, think about this: a survey by comScore revealed that about 46% of customers shopped for their auto insurance online. If you want people (especially the newer generation of buyers, such as millennials) to notice you, then you need to be where they are, and that is on the Internet.

Also, gone are the days when vendors controlled the information. Today, consumers want information, and they want it now. While many salespeople whine about the shift in power, technology has also brought about a more even playing field.

Establishing your online presence, specifically through social media, is not only inexpensive (or free in many cases), but it allows individual agents to play with the big boys. You can reach out to people using Facebook, Twitter, Google+, and LinkedIn; and it makes people feel like you’re always available whenever and wherever they are.

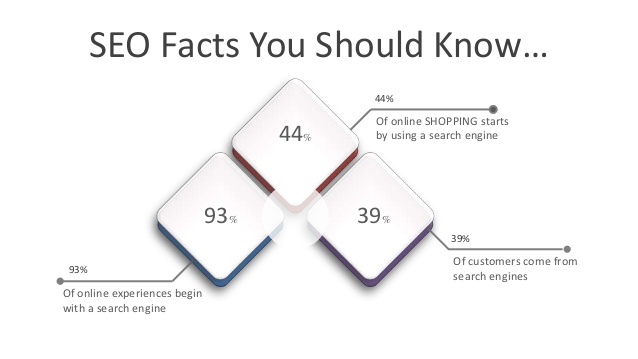

Of course, there’s more to Internet marketing than just social media marketing. For example, there’s search marketing. According to a study by Forrester, over 93% of online experiences begin with a search engine.

Source: Patel, Neil. Retrieved from http://neilpatel.com/blog/the-advanced-guide-to-user-behavior-data-and-how-it-affects-search-rankings/

That means, when people are searching for auto insurance, they first pull up Google, or even Bing and Yahoo! They use relevant search terms (keywords) that will help them answer their question(s), accurately, in the shortest time possible.

For any website owner, getting the #1 position, or even getting ranked on the first page, of any Google search result is extremely important, because only 8.5% of users ever go to the second page. That means more than 90% of people find what they are looking for on the first page of results. A good SEO (Search Engine Optimization) plan, plus ranking for your most lucrative keywords is important if you want to write more auto insurance policies.

2) Target the right customers

Most people think casting a wide net can help them catch more fish. While this may be true for fishing (or even in some aspects of marketing and advertising), with insurance, it’s generally not the most effective approach to marketing your agency. For one thing, car insurance is already a specialized market. Homeowners typically will own cars of greater value as compared to renters, right? Homeowners who live in higher income zip codes tend to have vehicles of an even greater value.

So, how can you make sure you’re targeting the right people? First, you need to know who your target market is – who are the people who are more likely to buy from you? Obviously, they would have to be car owners, but people are more than just what they own or drive. That’s the key here – find out who has a need for your products and services and go after them.

Some marketers may use demographics, but these days, you can use the power of technology to really zero in on your target market on a more granular level. This is where the buyer persona comes in. What is a buyer persona? Well, Hubspot defines it as, “a semi-fictional representation of your ideal customer based on market research and real data about your existing customers.” Instead of merely lumping all your ideal customers into categories defined by age, sex, income level etc., you actually can create profiles that represent them.

Source: Hubspot. Retrieved from https://blog.hubspot.com/hs-fs/hub/53/file-486747398-png/Buyer_Persona-1.png?t=1494245288816

How can you do this? Well, there are many ways, including:

- Sending out surveys

- Looking at your own customer database and finding trends

- Asking your sales team who they think your ideal customers are.

- Asking your current customers (face-to-face or phone)

When putting together your buyer personas, you have to create a semi-fictional representation of the type of customers you want to target. Give them a name, like “Soccer Mom Sally” or “Boss Barry.” Be specific about who they are and what they do. Creating buyer personas allow you to tailor your messages and find the right avenues of reaching out to them. For example, if you want to get in front of a persona called “Soccer Mom Sally,” then you probably want to make sure you’re at after-school events, fundraisers, and other family-friendly venues. On the other hand, you’ll want to be active on Linkedin, in your local chamber of commerce or other networking events if you want to meet “Boss Barry.”

Once you identify your ideal customers, then you can concentrate your marketing efforts (and budget) on prospects that you know will pan out.

3) Cross-sell to your other clients (the smart way)

One low-cost way of increasing your auto book is to cross-sell to your current clients that don’t presently have their auto covered by your company. After all, you already have their attention (and contact information) because you cover their home, boat, RV, etc, so why not approach them about adding or even increasing their auto coverage?

Sometimes, it’s as simple as picking up the phone and calling your list of clients. But, if you’re like most agency owners, you’re probably being pulled in a thousand different directions. Where does your team find the precious time? And, most likely, your customers are the same – they can’t always spare 10 or 20 minutes to talk about things like collision coverage or full glass replacement coverage and the value of why they need it.

There’s no simple answer to that question. Most of the “wildly successful” agents build it into their team’s calendars and coach to it in team, and one-to-one, sessions. Designing the right incentives can motivate many, e.g., paid time off, lunch at their most popular restaurants, Starbucks’ or Petes’ gift cards or a gift basket from COSTCO.

Next, you need to listen and keep your ears open. Often, when you have conversations with your prospects or clients, listen to what they’re saying or what they’re not saying. For example, many major life events can be an opportunity to cross-sell:

- Oh, you’re getting married and buying a house? It’s time to talk about the importance of having more life insurance. Perhaps it’s time for them to think about getting a second car. Soon maybe their kids start to arrive, which means they’ll have to buy a bigger, safer vehicle.

- Is their teen going to start driving soon, then perhaps it’s time to think about increasing coverage or looking into a more comprehensive policy. In many cases, they might not even realize they need additional coverage; you may be doing them a favor by pointing it out.

- Are they getting a promotion or new job that requires them to travel farther? Then perhaps it’s time to consider getting additional car insurance, especially if their commute is going to be longer.

Something you may want to do to help your team cross-sell is to do policy reviews with clients. Some of the major carriers call them IFRs (Insurance Financial Reviews). This is something you can do periodically, maybe once a year or so. Policy reviews allow you to catch up with your clients and see what’s new with them – did they get married? Have another baby? Pre-planning to finance kids’ college? Get a promotion, or maybe got a new job? Planning for retirement? You can offer to meet them for a review or maybe, if they are tech savvy enough, do an electronic survey.

You might even want to offer some type of incentive – maybe take them out for coffee or give a gift card to people who complete your survey. By arming yourself with the right information, you can cross-sell smartly, and use your team’s time even more efficiently.

{{cta(‘6cd948b1-c950-4b87-a5b9-f78540c3af5f’)}}

4) Provide Added Value Through Better Service

If many people consider auto insurance a commodity, then one of the ways you can really stand out from the crowd is to offer something better than your competitors, and one of those things is better service. And, when you do offer better service, your customers are more likely to recommend you to people they know, which builds your reputation, which in turn steadily builds your book of business. Referrals are the most ideal way to grow your business long-term.

Selling policies is the easy part, but how can you make sure your customers are satisfied? There are many ways to do this:

- Be proactive. Tell customers about upcoming promotions or better yet, ways they can better protect their family and their family’s assets. For example, you might want to call them up to tell them about no-claims discounts they can obtain before they renew their policy. You should also follow-up with them about their requests, rather than waiting for them to call you. Give them your “best bundle” based on their needs.

- Always give them tips. Of course, you can’t individually call your customers and give them tips out of the blue, so use different channels – for example, on social media. Your audience on social media are people who might be interested in different tips, from saving money on auto insurance or even tips about parenting, technology or other topics that might be of interest to them.

- Be their point of contact on all insurance matters. Always being available for questions is a great way to grow your relationship with clients, as well as establish yourself as an authority. Insurance is confusing, so help your clients by patiently answering their questions.

- Call just to say “hi” or “happy anniversary ” Insurance often has a negative connotation for most people – they only hear from agents when they’re following up after a disaster. So, why not give clients a call for other reasons? You might want to just catch up with them (which is a great opportunity to find out about major life events) or maybe congratulate them on some other achievement. That way, whenever they see your name on their caller ID, they’ll be more receptive to your other calls, whether it’s to follow up on a claim or if you want to cross-sell them on other products.

Doing all these things will not only make you a great insurance agent, but turn you into someone people can trust. And, when your clients trust you, the more likely they are to buy more of your products and services and recommend you.

Once you have established trust with your clients, you can be more confident about asking them for referrals. In fact, you may not even have to ask them – your current clients can be your best ambassadors, so treat them well.

Also, if you’re not comfortable asking them for referrals yet, then the next best thing you can do is ask them for Ratings & Reviews (R&Rs) online. Why would you want them to review and rate your? Well, for one thing, 88% of consumers trust online reviews as much as personal recommendations.

Source: Search Engine Land. Retrieved from http://searchengineland.com/figz/wp-content/seloads/2014/07/Local-Consumer-Rev-4.jpg

They can leave you a review on your GMB (Google My Business), Facebook or Yelp page, give a testimonial on your website (if you are a non-captive agent). If you have clients who are particularly social media-savvy, then it’ll be easy for them to post their reviews online. Email them your agency’s R&R links for the above sites. That saves them time from trying to find your business page R&R link and takes the hassle out for them. Properly execute on this strategy, and watch your R&Rs soar. Google and the other search engines will reward you for growing your R&Rs, too! Oh, and of course, don’t forget to say thank you. Write them a note, call them up and say thank you personally or even send off an email thanking them for their review or referral. It’s a small gesture, but one that people always appreciate.

Increasing Auto Insurance Policies: The Final Word

In today’s competitive world, insurance agents need to do more to stand out from the crowd, especially when it comes to writing more car insurance. Most customers see auto insurance as a requirement, and thus many will just look at the final cost when making their decision. It is, therefore, up to the agent to find ways he or she can market their policies as something more than just a piece of paper. By following the tips outlined above, you can not only make yourself more visible to customers looking for auto insurance but also become a better agent they can trust and recommend to their family and friends.

{{cta(‘6cd948b1-c950-4b87-a5b9-f78540c3af5f’)}}