It is a despairing fact, but many consumers don’t have the patience, sophistication, or wherewithal to learn about personal finance strategies on their own. Most people would rather “catch ’em all” playing Pokemon Go than discuss with an agent the finer points of annuities.

Add to that, the fact that annuities have gotten a bad reputation over the years, largely due to people misunderstanding the product, and there is little wonder then that agents shy away from selling annuities. But, for anyone willing to give this financial product a closer inspection, there are benefits to be had all-around.

In combination with other offerings, annuities make a lot of sense from an agent’s perspective. The ability to offer an additional product will help to strengthen your client’s financial goals and broaden your scope of offerings to attract new prospects amongst other things.

Understanding How Annuities Work

Annuities are income oriented insurance products that will no doubt bolster your agency’s offerings. It is essential, however, that you know how these products work so that you can make the best recommendations and help more clients.

As previously mentioned, most consumers are reluctant to delve deep into financial strategies. That is especially true with a product as seemingly complex as an annuity. Things often look a little more exciting once you unravel the complexities, though.

There are two basic categories of annuities: immediate and deferred.

Deferred annuity –

With this option, money paid to the insurance carrier is held and accumulates until the annuitant (the person holding the policy) signals that they want to begin making withdrawals. That typically happens when the person retires. In other words, the annuity income is deferred.

Immediate annuity –

This option, as the title suggests, allows the annuitant to begin receiving payments shortly after their initial deposit is made.

Within those categories, there are two main types of annuities: fixed and variable – although, a myriad of different types is currently available.

Variable Annuities –

This is a tax-deferred retirement contract allowing annuitants to choose from a range of mutual fund investments. The level of income paid is determined by the performance of the investments.

Fixed Annuities –

A fixed annuity contract obliges the insurance carrier to make a series of fixed payments (for life or some other chosen period). This option frequently provides a guaranteed, steady income for the annuitant.

Annuities are an important component of the broader retirement plan for many people. Clients can use these products to receive money now or accumulate a nest egg for retirement. In many cases, it just requires a knowledgeable agent to point out the key benefits.

Annuities and Your Business

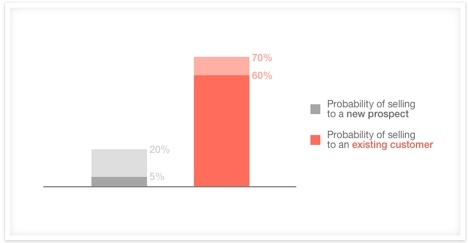

Offering annuities can help bring real value to your clients. It can also help to shore up your agency’s bottom line. Firstly, it is important to note that clients who buy annuities from you will often come back for more. Plus, if their experience is good, they will tell other people about you.

Also, depending on the annuity’s benefits, your clients will be reducing their income risk. With reduced risks in one section of their portfolio, they will have a greater capacity for market risk in other areas. That presents more opportunities for you to sell other products.

Selling Annuities to Benefit Your Client

Of course, to fully reap the rewards of selling annuities, you will have to put the needs of your client’s first. The key is to match people to the right annuity product. In buying the right annuity, your client can benefit in numerous ways. Here are just three of them:

Triple compounding and tax deferral –

Interest is paid on the principal, interest earned, and also on the taxes that would have been paid if the investment was subject to annual taxing.

Guaranteed lifetime income –

After age 59 ½, annuitants can access cash without any tax penalties whatsoever. It might also be possible for your clients to access some of the account in the event of an emergency before reaching retirement. That makes annuities one of the most flexible retirement plans around.

A safe and convenient way to transfer wealth to beneficiaries –

With annuities, clients can avoid the hassle of probate. That means not having to worry about the court deciding who should be the beneficiary of your client’s financial legacy.

Annuities are one the simpler financial products and should be fairly easy to sell. Your clients will want access to the latest annuity rates as well as up-to-date information as it pertains to their situation. Provided that, and you will surely develop a lucrative new source of revenue for your agency.

Staying Relevant

The insurance and financial services market are multi-generational. When selling annuities, it is important to do everything possible to remain relevant across each age group. For many agents, challenges arise when it comes to dealing with those mysterious millennials.

Technology has given rise to things like “Robo Advisors” – software that uses algorithms to gather data and automatically give people financial advice. That type of thing is appealing to the millennial generation who have a particular affinity for technology. It has led some experts to declare the role of an agent obsolete.

In fact, agents are more important now than ever before. There are important differentiators between auto advice and that of an agent, including the ability to provide an integrated, multi-dimensional plan.

Investments are only one part of a financial plan and working face-to-face is the best way for clients to develop and implement a suitable strategy.

To stay relevant and best serve the world’s increasingly dominant generation, you need to use a combination of technology and the tried and tested human approach. You could offer something like an annuity rate calculator on your website, to help give interested clients a glance at their potential earnings should they buy an annuity.

Couple that with a meeting to discuss the finer details, and you stand a good chance of landing a happy client, regardless of the generation.

Finally

If you currently sell other financial products, like life insurance, you already understand the intricacies of meeting client’s needs. Adding annuities to your sales portfolio boosts your ability to help clients achieve their goals.

Finding prospects that might be interested in annuities should not be that difficult either. If you look through your book of life insurance clients, you will no doubt find numerous opportunities. Life insurance clients are comfortable with insurance backed products as well as non-FDIC solutions. Taking advantage of the opportunity might just be as simple as asking.