Customer relationship management plays a very important role in the success of an insurance business. This activity allows an insurance business to attract new clients, increase the awareness of their brand and, most importantly, get more permanent clients.

It goes without saying that insurance agents should do every single thing possible to build and maintain good relationships with their clients. There has been a lot of talk about the importance of having an effective CRM system for an insurance business.

Generally speaking, a CRM system helps insurance agents grow their business. With an effective CRM system, insurants agents can accomplish their marketing goals easily. Today, we’ll provide tips that the owners of insurance business should follow to get the most out of customer relationship management efforts.

So, let’s get started.

Choose the Right CRM System

First and foremost, insurance agents have to analyze their customer relationship management needs carefully. After that, they have to pick a CRM system that meets their needs best. Insurance agents should pay a close attention to CRM system’s key features. CRM systems that come with such features as lead management, workload management and communication tools would be the right choice for an insurance business.

Customer Data Centralization

Customer data in a CRM system has to be centralized. A CRM system should provide a comprehensive view for each client and streamline communication. A CRM system that comes with such a feature as customer data centralization allows users to get all the necessary information about each customer quickly and successfully.

Segmentation and Targeting

It’s necessary to target the right type of clients when marketing an insurance business. That’s why it’s so important to collect such important data as client’s demographics and policy types. After that, segmentation of clients needs to be done.

Insurance agents should aim to pick a CRM system that makes segmentation easy and allows them to target the right type of customers. Getting these important data helps improve communication with clients and develop an effective marketing strategy that works well for an insurance business.

Automated Communication

CRM system’s automation features make it easy for insurance agents to communicate with their customers. Automation helps insurance agents make their communication with clients during the work process much easier. With automation tools, insurance agents will manage to send emails

for policy renewals as well as emails with birthday greetings on time. Automation tools help insurance agents create personalized emails for customers.

Lead Management

Lead management is an important part of marketing an insurance business. Insurance agents should try to attract new prospects to their business and then turn prospects into paying customers. With an effective CRM system, insurance agents will find it easy to analyse sources of leads and conversion rates.

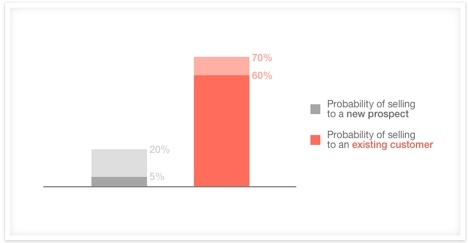

Cross-Selling and Upselling Opportunities

Data provided by CRM helps insurance agents understand their clients better. A CRM system will provide you with the information on client’s needs and preferences. This type of analysis will help you come up with great ideas and provide you with the additional cross-selling and upselling opportunities.

Task Automation and Reminders

When running an insurance business, it’s necessary to perform tasks on time. The help of automation tools and reminders is immeasurable in the work of an insurance agent. A good CRM system has everything that insurance agents need to run a business smoothly.

Integration with Other Tools

Sometimes, a need to integrate a CRM system with other tools arises. Let’s say that you would like to use email marketing for an insurance business. Luckily, the modern CRM systems can be integrated with other tools and systems easily. For example, insurance agents can easily integrate their CRM systems with email marketing platforms. As a result, the functionality of a CRM system improves significantly.

Customer Service Excellence

Providing effective customer support is crucial for success of an insurance business. Insurance agents have to be committed to the best possible customer experience. They should answer all questions of their clients and resolve their issues quickly and efficiently. It’s important to know that a CRM helps insurance agents support their clients in the best possible way.

Feedback Collection

With a CRM system, insurance agents can easily collect feedbacks from their clients. So, they will be able to see what people say about their insurance business. If, for example, some clients are not happy with insurance service then agents have to make changes to their business as soon as possible. Take an action to resolve client’s issue and turn an unhappy client into a happy one.

Data Security and Compliance

Data security is important for every business. An insurance business is no exception. The modern CRM systems come with all the necessary tools that insurance agents need to keep their client’s data secure.